Vanuatu has made substantial progress on several innovative initiatives on financial inclusion in the past year.

A briefing by the National Financial Inclusion Council (NFIC) provided an update on financial inclusion achievements made in the past year.

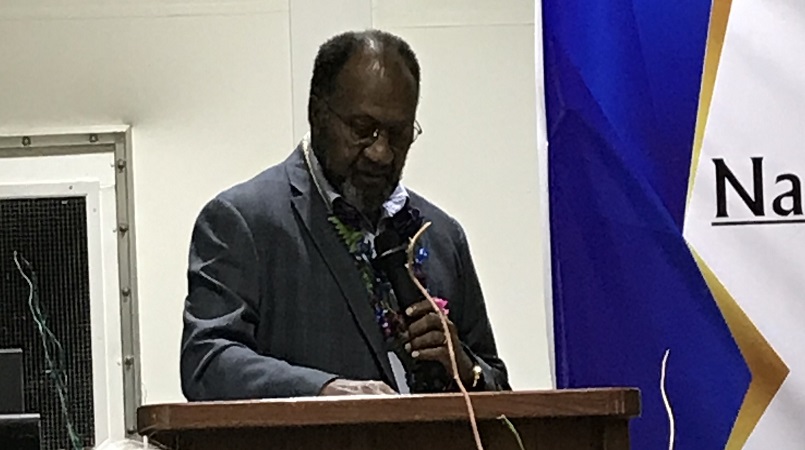

The Council, which is chaired by Prime Minister, Charlot Salwai Tabimasmas, includes ministers of key portfolios such as Tourism, Finance, Education and Agriculture and the Governor of Reserve Bank.

Attendees heard about some of the new and upcoming innovative initiatives that are currently being tested and awaiting deployment in the market in the months to come.

The initiatives have been funded through the UNCDF Pacific Financial Inclusion Programme (PFIP) and the Governments of New Zealand and Australia.

One of them involved a shift to digital platforms.

Last year the National Bank of Vanuatu moved 30,000 rural customers from paper-based passbooks (legacy) to using digital financial services like ATMs, SMS banking, internet banking and the expansion of an agent network (merchants) equipped with POS terminals.

Also, in the works is a new Mobile App that will allow customers to access account information and transact using their mobile at their own convenience.

There is also a programme for weather based insurance products.

A feasibility study was conducted in March this year by PFIP and the Munich Climate Insurance Initiative (MCII) to determine how weather -related events have impacted the livelihoods of Pacific Islanders.

The study has also mapped vulnerable groups and communities.

From the study, PFIP and MCII have proposed the development of new appropriate disaster risk financing strategy and corresponding implementation plans, including: suitable index-based insurance products covering the risk profiles identified, reinsurance coverage, insurance distribution arrangements, etc.

This is proposed to be a macro, meso and micro scheme covering communities, small businesses as well as individuals.

Following the successful deployment of an affordable bundled microinsurance product in the Fiji market, FijiCare Insurance Limited’s subsidiary, VanCare announced at the event the launch a similar product for Vanuatu, following approvals from the RBV.

The product will provide protection for fire, death, personal injury and includes a funeral benefit as part of the package.

Mobile money services linked to remittances in another initiative on financial inclusion.

Telecom Vanuatu Limited (TVL) will be the first mobile telephony operator in Vanuatu to offer mobile money (e-wallets) services.

With technical support from their parent company Vodafone Fiji (ATH group), TVL has completed the technical integration of the mobile money platform and will soon be commencing user testing of services.

It is expected to be available in the market by July’19.

Digital Financial Services have been set as a key priority under the 2018 – 2023 National Financial Inclusion Strategy with the government aiming to extend financial access to the 32% of Ni-Vanuatu adults who are excluded from both formal and informal financial services.

The Governor of the Reserve Bank of Vanuatu, Simeon Malachi Athy in his welcome address at the meeting said “innovative financial inclusion means improving access to financial services for the disadvantaged and marginalized Ni-Vanuatu through the safe and sound spread of new approaches or technologies. Good policies and regulation are critical to support current innovations and to strengthen financial inclusion. This is because the enabling environment will critically determine the speed at which the access gap for financial services will be narrowed.”

The Governor added “the world today is powered by businesses innovation which leads to efficiency gains and faster economic growth to meet the challenges of tomorrow. Therefore, there is a great need for collaboration between appropriate authorities to help create an enabling policy and regulatory environment for innovative financial inclusion”

PFIP Deputy Programme Manager Krishnan Narasimhan said severe climate related natural disasters are becoming increasingly frequent in the Pacific with Vanuatu being the most vulnerable.

“PFIP in partnership with MCII completed the initial feasibility assessments in Vanuatu and are now developing a comprehensive disaster risk manager and financing framework, we will work with all stakeholders in developing the implementation strategy.”

He further added “PFIP through its grant and technical support to digital financial service providers like NBV, TVL and VanCare is committed to supporting RBV in its implementation of the National Financial Inclusion Strategy. This support comes through funding from the Australian Government Governance for Growth program and we are thankful to them for the assistance.

The Australian High Commission was represented by Clinton Pobke – Program Director of Governance for Growth Program, who alongside the Prime Minister unveiled upcoming digital financial products and services.

The briefing was facilitated by the Reserve Bank of Vanuatu (RBV) in partnership with members of the National Financial Inclusions Taskforce (NFIT) and was attended by representatives including the New Zealand High Commissioner to Vanuatu Jonathan Schwass, senior Government officials, CEOs and senior officials of financial service providers, mobile network operators and civil society representatives.

Photo supplied. Caption: Vanuatu PM Charlot Salwai